Checking accounts

Stay connected with more control.

Opening a checking account online or at your local OnPoint branch provides the convenience you need to manage your money easily. With access to over 50 local branches, along with digital banking, you’ll be able to do what you need and get back to enjoying your life.

Digital access

Check account balances, transfer funds, pay bills and more, from anywhere.

57 local branches

Enjoy extra peace of mind with ongoing support from a local team that’s here when you need them.

Global ATMs

Use your free Visa® debit card1 to access over 40,000 surcharge-free ATMs.

Direct deposit

Automatically deposit your paycheck into your account every payday using your routing and account number.

Compare checking accounts

Best for:

Best for:

Minimum to open an account

Minimum to open an account

Minimum balance required

Minimum balance required

Monthly Service Fee (if min. balance requirement is not met)

Monthly Service Fee (if min. balance requirement is not met)

Free digital banking access

Free digital banking access

Send money with Zelle®

Send money with Zelle®

No fee cash withdrawals from any ATM3

No fee cash withdrawals from any ATM3

Tiered dividends

Tiered dividends

Free e-statements

Free e-statements

Interest checking

Best for:

Earning a little extra. You get all the features plus a monthly dividend.

Minimum to open an account

$0

Minimum balance required

$5002

Monthly Service Fee (if min. balance requirement is not met)

$72

Free digital banking access

Send money with Zelle®

No fee cash withdrawals from any ATM3

Tiered dividends

Free e-statements

OnPoint checking

Best for:

Simplicity of an everyday account with no fuss and no minimum balance requirements.

Minimum to open an account

$50

Minimum balance required

$0

Monthly Service Fee (if min. balance requirement is not met)

$0

Free digital banking access

Send money with Zelle®

No fee cash withdrawals from any ATM3

Tiered dividends

Free e-statements

Additional rate info.

Conveniently manage your money online.

When digital banking is easier, life is too. Enjoy more flexibility, security and control of your finances with anytime, anywhere banking access and easy-to-use tools. Get in, get out and get back to your life—it’s safe, secure and simple.

Mobile deposit

Deposit checks anytime, anywhere from your smartphone.

Overdraft protection

Protect yourself from overdrafts and get more peace of mind by linking your credit card to your checking account.

Bill payment

The no-fuss, no-hassle way to pay all your bills online, on time.

Person-to-person

Send money simply and securely to your family and friends.

Account management

Check your balance, update your personal information, and more.

Finance manager

Track and categorize your spending, set monthly savings goals and create budgets.

Alerts

Receive text4 or email alerts to stay on top of your transactions and account balance.

Account security

Verify your login with a secure access code sent via text or phone.

Touch ID & Face ID

Quickly log into Digital Banking securely on supported devices.

Travel notifications

Access your account on the go and keep your account secure by scheduling travel dates in your account.

Customized experience

Simplify your banking by giving each account a custom name or reorder the appearance of your accounts.

Digital transfers

Make bill payments and swift and secure transfers between your accounts and elsewhere.

Who can open a checking account with OnPoint Community Credit Union?

You’re eligible for membership if you meet any one of the following criteria:

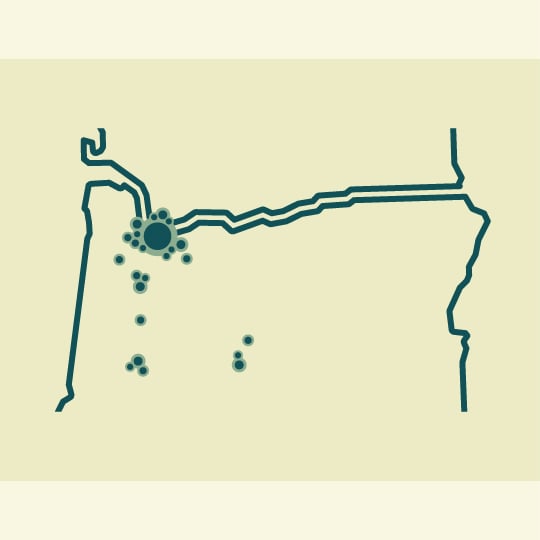

Oregon

You live or work in any of the counties we serve, or you’re a family member of a person who is eligible for OnPoint membership. The 28 counties we serve in Oregon: Benton, Clackamas, Clatsop, Columbia, Coos, Crook, Curry, Deschutes, Douglas, Gilliam, Hood River, Jackson, Jefferson, Josephine, Klamath, Lane, Lincoln, Linn, Marion, Morrow, Multnomah, Polk, Sherman, Tillamook, Wasco, Washington, Wheeler, or Yamhill.

Washington

You live, work or worship in any of the counties we serve, or you’re a family member of a person who is eligible for OnPoint membership. The 2 counties we serve in Washington: Clark and Skamania.

Open an account online

What you'll need to apply online:

- Be a legal U.S. resident

- Be at least 18 years old (To open a youth membership, please visit an OnPoint branch.)

- Have a Social Security number

- Have a debit or credit card to fund your account(s)

- Have a government issued ID (Driver's License, State ID card, Passport. Permanent Resident Card, Military ID card)

Open your checking account today.

Get started today.

Open an accountStop by an OnPoint branch.

Find a nearby location or ATMDisclosures

- The first card is free, the first replacement each year is free, and subsequent card replacements will incur a $5 card replacement fee.

- If the minimum monthly average balance is met, the $7 monthly fee will be waived.

- Please be aware that while OnPoint will not charge ATM fees with Interest Checking, you may be assessed a surcharge by another financial institution.

- Please be aware that while OnPoint’s mobile banking services are free, your mobile carrier may assess text messaging and/or web access charges.

If you request a substitute check, please read the Check 21 disclosure.

Click here to read the Truth in Savings Disclosures.